mississippi income tax brackets

3 on the first 5000 of taxable income. AP -- Mississippi residents will pay lower income taxes in coming years as the state enacts its.

Mississippi Tax Rate H R Block

Individual Income Tax.

. There is no tax schedule for Mississippi income taxes. Below we have highlighted a number of tax rates ranks and measures detailing Mississippis income tax business tax sales tax and property tax systems. If youre married filing taxes jointly theres a.

Discover Helpful Information and Resources on Taxes From AARP. These rates are the same for individuals and businesses. No Matter What Your Tax Situation Is TurboTax Has You Covered.

Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi State Personal Income Tax Rates and Thresholds in 2022.

Any income over 10000 would be taxes at the highest rate of 5. How does Mississippi rank. 4 on the next 5000 and.

Ad Free tax support and direct deposit. The graduated income tax. The corporate rates and brackets match the individual rates and brackets and the brackets contain a marriage penalty because the rates kick in at the same marginal income levels regardless of filing status.

On Tuesday the Mississippi Senate delivered an income tax cut plan that would phase out the four percent income tax bracket. 5 on taxable income over 10000. The first step towards understanding Mississippis tax code is knowing the basics.

If you are receiving a refund. 4 rows Mississippi state income tax rate table for the 2020 - 2021 filing season has four income. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately.

Mississippi one of the poorest states in the nation has struggling rural. Here is information about Mississippi Tax brackets from the states Department of Revenue. Click the tabs below to explore.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Single married filing separate. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the.

The Mississippi Single filing status tax brackets are shown in the table below. Mississippi personal income tax rates. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022.

The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. Mississippi Income Taxes. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. The tax brackets are the same for all filing statuses. These income tax brackets and rates apply to Mississippi taxable income earned January 1 2020 through December 31 2020.

Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. In 2009 median income was about 25000 over the top income tax. Mississippis income tax brackets were last changed three years prior to 2019 for tax year 2016 and the tax rates have not been changed since at least 2001.

4 rows The Mississippi income tax has three tax brackets with a maximum marginal income tax. Mississippi Income Taxes. Mississippi has a graduated tax rate.

Your 2021 Tax Bracket to See Whats Been Adjusted. This income tax calculator can help estimate your average income tax rate and your salary after tax. Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income.

3 rows Mississippis income tax brackets were last changed four years prior to 2020 for tax year. When the current income tax brackets were created the top bracket was under the median household income by about 5000. All other income tax returns.

Mississippi state income tax brackets are as follows. Senate plan will eliminate the 4 income tax bracket over four years but is not a complete elimination of income taxes at this time. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

The Mississippi Legislature is tackling income tax and how to get rid of it in the 2022 Legislative session. Ad Compare Your 2022 Tax Bracket vs. Taxpayer Access Point TAP.

The latest available tax rates are for 2020 and the Mississippi income tax brackets have not been changed since 2019. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

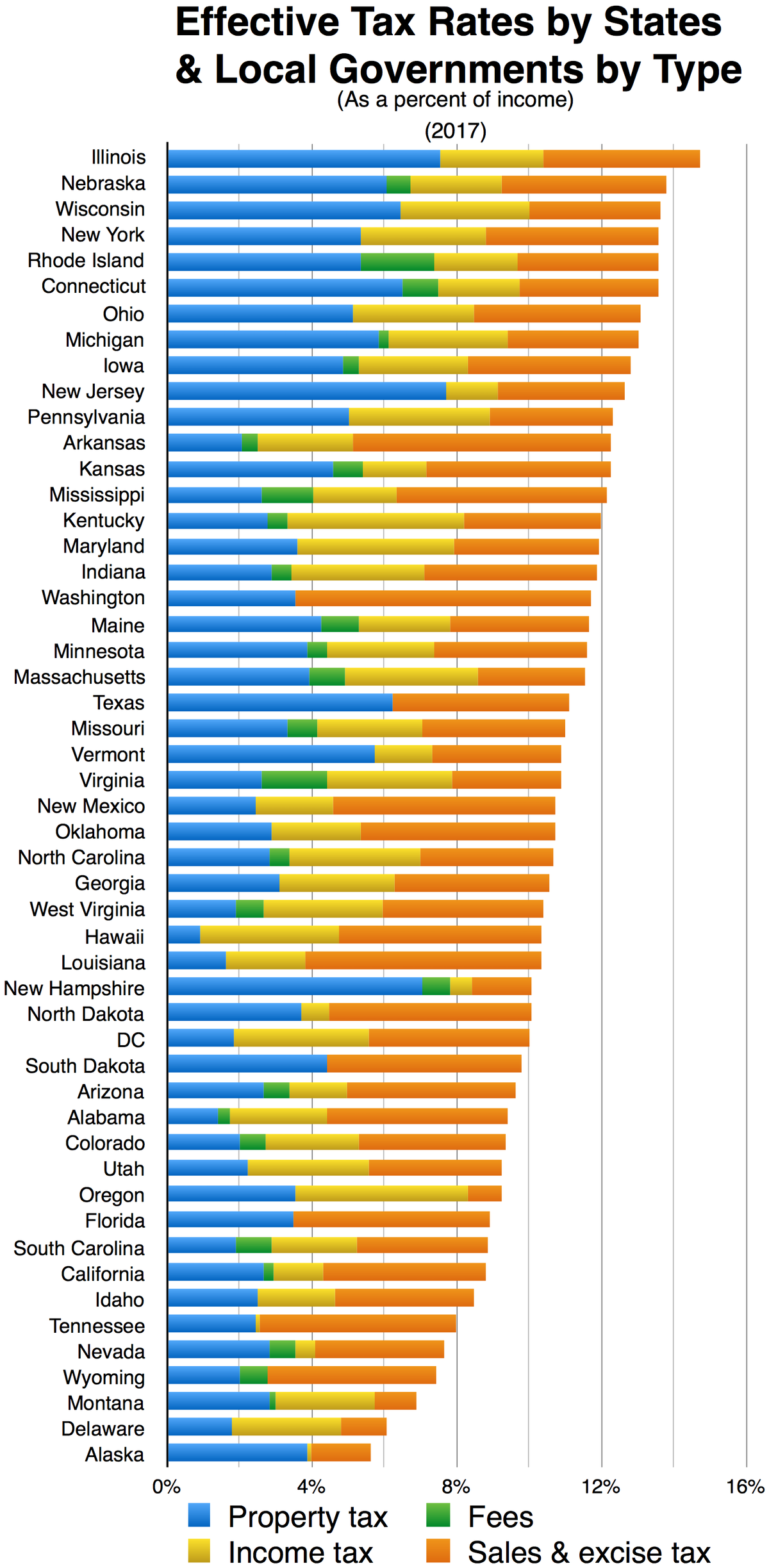

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

Will 18 Billionaires Solve Illinois Financial Problems Governor Pritzker Has A Hidden Agenda To Increase Everyone S Taxes Roy F Mccampbell S Blog

File State And Local Taxes Per Capita By Type Png Wikipedia

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Senate To Drop Tax Reduction Plan To Eliminate 4 Income Tax Bracket Mississippi Politics And News Y All Politics

Mississippi Tax Rate H R Block

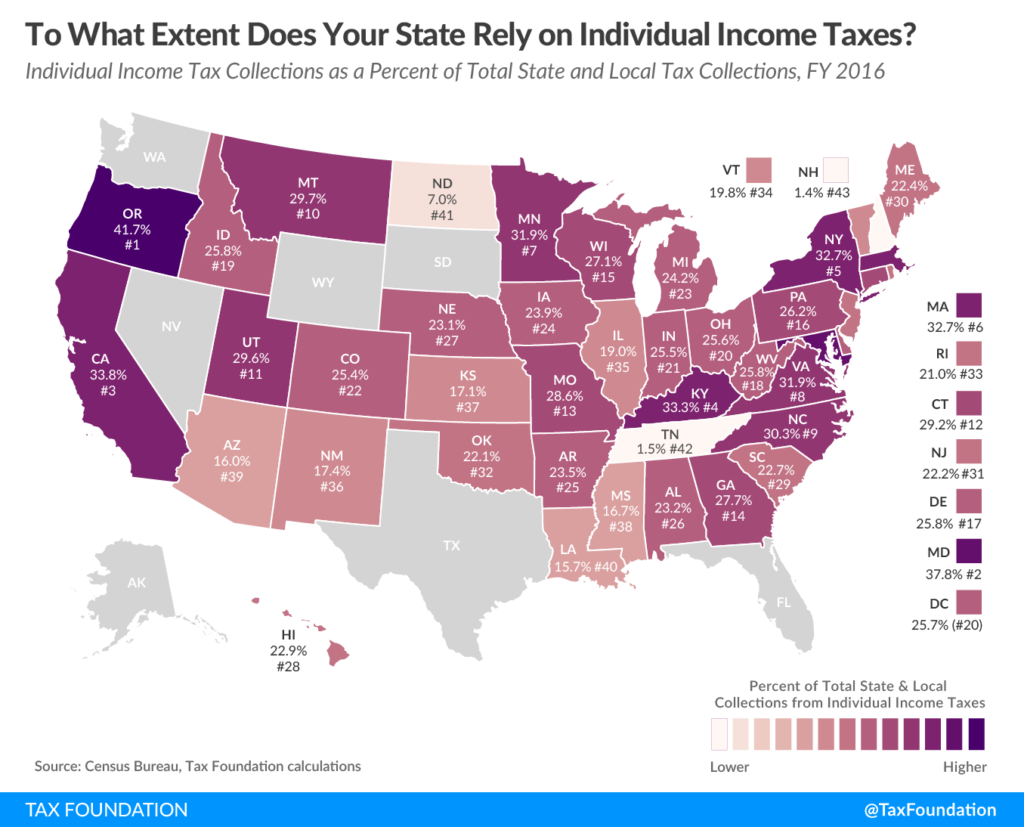

A Look At Mississippi S Reliance On Individual Income Taxes Mississippi Center For Public Policy

Tax Rates Exemptions Deductions Dor

Mississippi State Tax Tables 2022 Us Icalculator

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Mississippi Ranks 30th In 2022 Tax Foundation State Business Tax Climate Index Mississippi Politics And News Y All Politics

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Combined State And Local General Sales Tax Rates Download Table

Strengthening Mississippi S Income Tax Hope Policy Institute

Individual Income Tax Structures In Selected States The Civic Federation

Mississippi Income Tax Brackets 2020

Mississippi State Income Tax Ms Tax Calculator Community Tax